Contents of the reports

Mergers and divisions

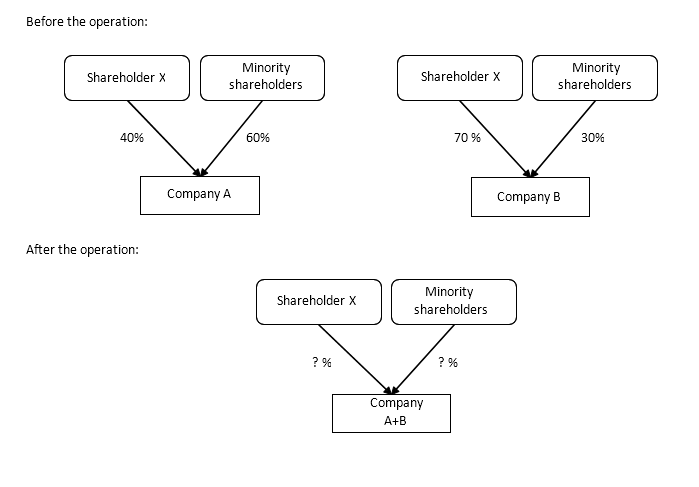

The reporting obligation in the event of a merger and of a division is very similar.

First, the management body must draw up a proposal for a merger or division. Next, it must prepare a merger or division report that describes the assets of the companies concerned, providing comments and a justification from a legal and economic viewpoint of the desirability of the operation, the terms on and manner in which it will take place and its consequences.

The merger or division report must indicate the share exchange ratio and the method according to which it was determined, the relative importance to be attached to these methods and the valuation arrived at (see FAQ 7). If any particular difficulties were encountered when determining the exchange ratio, this must be mentioned in the reports.

Finally, the statutory auditor must also prepare a written report stating whether or not, in his or her view, the exchange ratio is reasonable.

Contributions in kind

In the event of a capital increase via contributions in kind, the management body of the company receiving the contribution must prepare a report explaining why the contribution is of interest for the company, as well as providing a description and a reasoned assessment of the contribution.

The statutory auditor must, in turn, draw up a report explaining the contribution and the valuation methods used. Unlike in the case of a merger or division, for contributions in kind, the law does not require the statutory auditor to give an opinion on the reasonableness of the valuation used.

The management body must, where applicable, also indicate why the conclusions of the statutory auditor's report were not followed.

Publication of the reports

A proposal for a merger or division must be filed by each company involved, six weeks before the general meeting, with the clerk's office of the commercial court in the district in which the company has its registered office, and must be published by means of an extract or in the form of a notice in the Annexes to the Belgian Official Gazette (Moniteur belge/Belgisch Staatsblad).

A proposal for a merger or division and the other legal reports, as well as the special reports relating to a contribution in kind, must be mentioned on the agenda of the general meeting which is to decide on the merger or division proposal or the capital increase as a result of a contribution in kind.

Listed companies must make the reports available to shareholders on the company website at the latest on the date of publication of the notice of general meeting, that is, at least 30 days before the general meeting.

Listed companies must submit the FSMA the notice of general meeting, including the documents to be put before the general meeting. They must do so at the latest at the time when the information is made available to the shareholders. The FSMA will publish that information via STORI[1].