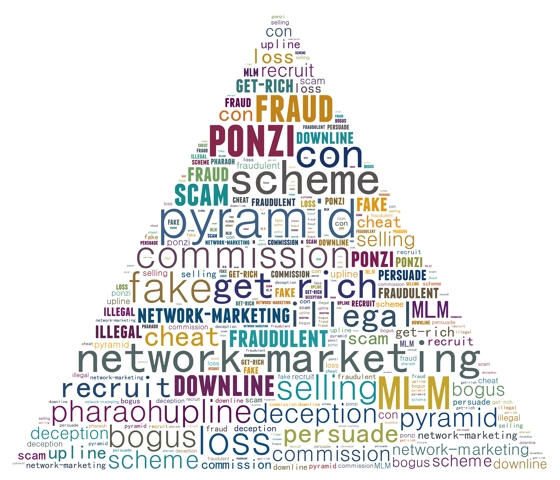

Pyramid schemes are a type of fraud in which the initiator of the pyramid offers the potential investor the opportunity to make an investment that promises a very attractive return, far above the market rate.

The initiator thus receives the first payments from investors who have been taken in by the prospect of a high profit. Contrary to what the investors were promised, their money is never actually invested. Rather, the investors are asked to bring in new investors themselves and are promised increased profit if they do so. New investors who enter the system bring in money, which once again is not invested but used in part to pay returns to the first investors.

The initiator thus receives the first payments from investors who have been taken in by the prospect of a high profit. Contrary to what the investors were promised, their money is never actually invested. Rather, the investors are asked to bring in new investors themselves and are promised increased profit if they do so. New investors who enter the system bring in money, which once again is not invested but used in part to pay returns to the first investors.

With this type of fraud, all the consumers taken together make up the pyramid. The higher one rises in the pyramid structure, the greater the chance that he or she can earn a lot of money. As in the case of Ponzi schemes, the fraud is discovered once too few new investors join.

Be vigilant, since consumers participating in a pyramid scheme risk not only losing their money, but are also accessories to a criminal offence. If a consumer benefits from the payment of an indemnity. If consumers participating in a pyramid scheme can earn money on their initial investment as a result of having recruited new consumers to join the scheme, rather than from the sale or use of products, this constitutes an unfair business practice.

Do you suspect that the offer being made to you may be fraudulent?

Have you been the victim of investment or credit fraud and you don’t know what to do?

If so, please contact the FSMA directly.

Don’t fall into the trap, follow our recommendations!

Always check the identity of the person or company contacting you (have you checked the name, registered office, home country, contact details and whether it holds an authorization to make you this type of offer?).

If you cannot clearly establish the company’s identity, it should not be trusted. If the company is based outside the European Union, you should be aware of the difficulty of legal recourse in the event of a dispute.

Be wary as well of ‘cloned firms’.

These are companies that pass themselves off as different, lawful companies even though they in fact have no connection with the latter. A close look at the email addresses or contact details for the companies in question may prove useful in order to detect potential fraud of this sort.

Always ask the person contacting you to provide clear and comprehensible information.

Never invest if you do not understand precisely what is being offered. Be sure always to verify the information you are given.

Lastly, be wary of (promises of) disproportionate returns.

If a return seems too good to be true, it usually is.